Simplified Debt Restructuring for Small Business

This is the seventh article in a series of articles aimed at informing directors of their duties, and the options available for small to medium enterprises (SME) if faced with insolvency or financial distress.

As a result of the COVID-19 pandemic and associated economic downturn, the Australian Government made changes to the insolvency framework with the aim of helping more small businesses restructure and survive that difficult period. The Small Business Restructuring (SBR) process is one of two new formal insolvency appointments introduced by the Federal Government in 2021. With the help of a registered liquidator (called a small business restructuring practitioner – SBRP), a company can put forward a plan to its creditors to restructure its existing debts, while allowing the directors to remain in control of the business, property, and affairs of the company during the restructuring period.

Qualifying for the Small Business Restructuring (SBR) Process

To be eligible for the SBR process, your business must meet the following key requirements:

Be operated by a company (Pty Ltd entity) .

Have less than $1 million in liabilities (provable debts per Section 553 of Corporations Act and excluding employee entitlements).

All outstanding employee entitlements, including superannuation, must have been paid (noting that this does not include entitlements not yet due for payment, such as accrued annual or long service leave).

All tax lodgements for the company must be up to date (BAS and income tax returns).

The company must be insolvent or likely to become insolvent at some future time*.

The company and its directors (including former directors in the last 12 months) cannot have utilised either a simplified liquidation or the small business restructuring process in the last 7 years.

The company must not already be subject to an insolvency administration.

*insolvent means unable to pay its debt as and when they fall due and payable.

To avoid defaulting during the restructuring process, the company must continue to substantially comply with all the tax lodgements and payment of employee entitlements, including superannuation.

What debts are included in the plan?

The restructuring plan includes all unsecured debt (including shortfalls to secured creditors and participating secured creditors debts), which was incurred prior to the company entering SBR. However, the plan does not include employee entitlements (including those not yet payable, for example, wages, leave, or redundancy entitlements). If you incur new debt after the company enters the SBRP, this must be paid off outside the plan.

Effects on Creditors

Secured creditors and unsecured creditors

When a company enters into restructuring, a moratorium is applied on unsecured creditor claims and some secured creditor claims. This means unsecured and some secured creditors are prohibited from taking any enforcement action against the company without the RP’s consent or the court’s permission. That is, any legal action, enforcement of their claims and security interests (other than perishable property) against the company, is disallowed.

On personal guarantee

A creditor cannot enforce any personal guarantees held against the director their spouse, or their relatives in relation to a liability of the company.

On winding up application

If a legal proceeding has progressed to the point where an application has been made to have the company wound up, the action must pause during the SBR. The court is to adjourn the hearing of the winding up application if the court is satisfied it is in the interests of creditors to continue under restructuring rather than being wound up.

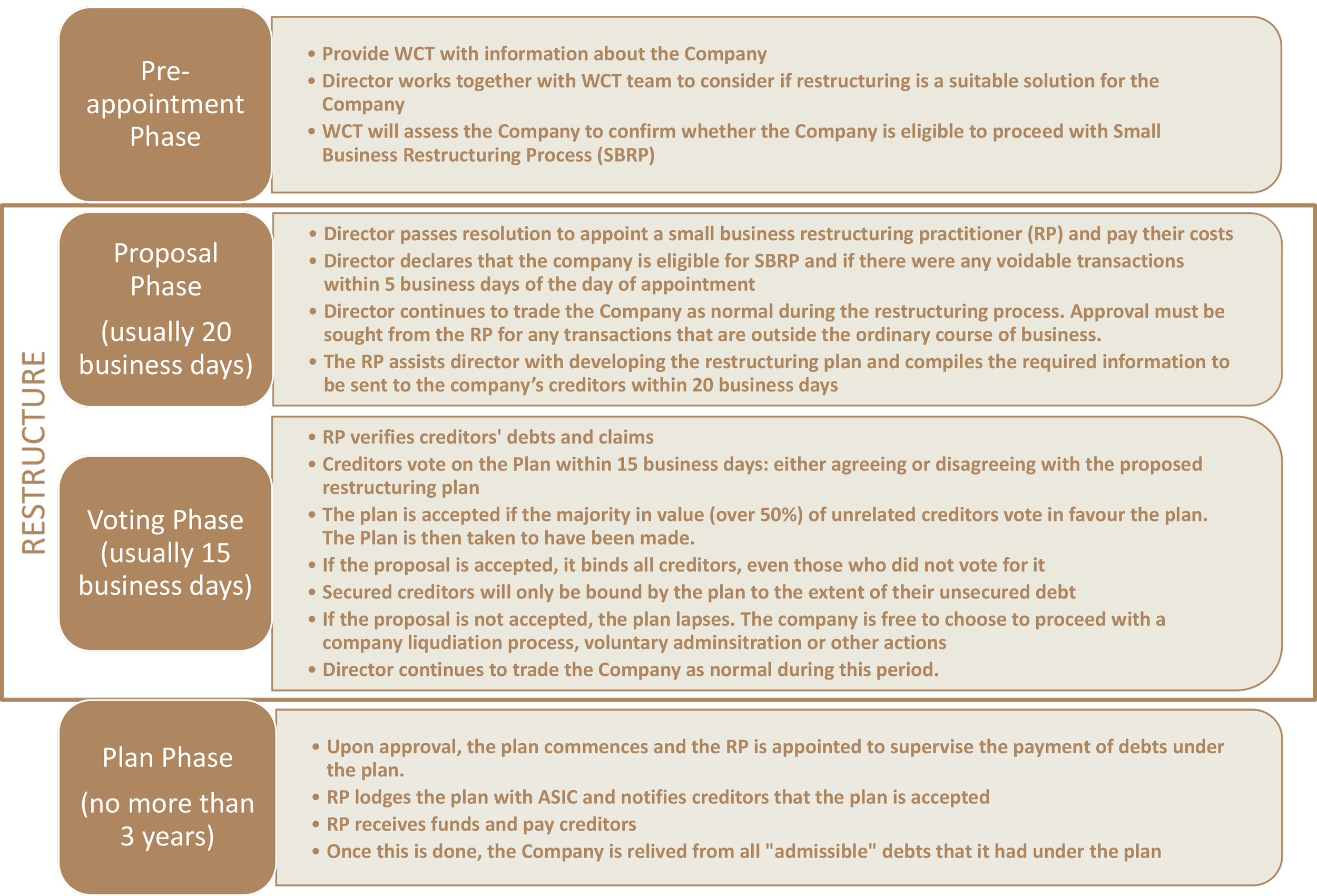

What does the Small Business Restructuring (SBR) process look like?

Pros and Cons of Small Business Restructuring (SBR)

Pros |

Cons |

The whole SBR process is a very quick turnaround. |

Tight timeframes and potential, if proper preparation not completed, to miss deadlines or have creditors vote against proposal. |

The process is simpler and lower cost than traditional formal insolvency appointments. |

Potential impact on insurances. |

Unlike Voluntary Administration, directors remain in control of the business’ day-to-day operations, which allows the company to preserve the goodwill value of the business. No disruption to key relationships with customers, staff, and landlords. |

If a director has provided a personal guarantee for a company’s debt, the director would still be liable for the shortfall debt. |

Allows company to renegotiate its debt with its creditors with a significant debt reduction. |

Whilst creditors can change their vote, and the proposal can be amended during the process, once the deadline ends, there will be no other opportunity to do another proposal. |

Based on our experience, the ATO are supportive of the SBR process. It benefits the economy by helping its ‘backbone’, small businesses. |

$1 million debt ceiling – including related party claims and secured debt (but excluding employee entitlements). |

ATO may agree to reduce interest and penalties owed by a company in a payment arrangement, but the ATO would rarely agree to reduce core tax debt. The SBR process can help the company to settle the core tax debt with the ATO and continue trading. |

The company is deemed insolvent once a restructuring plan is sent to creditors. If the plan is terminated or is not approved by creditors, creditors could use this as grounds for a winding up application. |

Acting early may mitigate directors’ liabilities for insolvent trading under S588 of the Act (more about insolvent trading can be found here) and from being personally liable for ATO debt. |

Potential Impact on trade credit relationships as a result of the restructure. |

Significant cash flow improvement for the company. |

The trade supplier community may not embrace the process. |

The sooner you act, the better your chances of turnaround and survival

Acting sooner rather than later will prevent potential issues from developing into insurmountable problems. A SBR may provide a vital lifeline to assist you or your client to get your business back on track. However, it is critical for business owners to understand their obligations during the restructuring process, and more importantly, develop solutions to the underlying issues of the business in order to break the vicious cycle of financial distress.

The WCT Advisory team can help you or your clients diagnose the core issues, develop solutions together that will save you or your clients money and achieve the goal of turning around the business by improving the outcome of the restructure.

Should you wish to discuss whether a SBR is the right solution for you or your client, please do not hesitate to contact our experienced team on 07 3493 5926 for a free, confidential consultation. If the SBR is not suitable for your situation, we have multiple options available to you that can help to bring your business back to life.